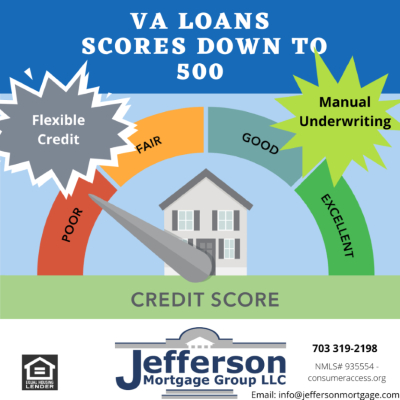

Most veterans are relegated out of the VA Loan Program by the marketplace for having lower credit scores and credit related issues. Many lenders shy away from VA borrowers with less than 620 credit scores and others have instituted underwriting overlays

Mar 03, 2020 | mortgage VA Low Score VA LOAN manual underwrite

Low interest rates have, in one perspective, liberated older homeowners by giving them many choices to stay in their family homes with Jumbo Reverse Mortgages. Some of the choices may include paying off existing mortgages and other debt, adding liquidity

Oct 16, 2019 | supplemental retirement income Age in Place downsizing Jumbo Reverse Mortgage 55+ High-Value Homes

Federal rules from Dodd Frank have made it much tougher for borrowers outside the traditional channels, such as Fannie Mae, Freddie Mac, and the government loan programs, to qualify for mortgages. There are some interesting products for the self-employed

May 02, 2019 | Traditional Mortgage Specialized Forward Mortgages Non QM mortgage Asset Qualifer Asset Based Mortgage

A husband and wife in their late sixties are comfortably retired in a nice family home with the exception of mortgage payments. Everyone they have spoken with recommends selling their home and downsizing but they reject that notion. They like their home

Jan 16, 2019 | lifetime income with a Reverse Seniors private label reverse mortgage Retirement security Jumbo Reverse Mortgage 55+ High-Value Homes

Over my entire career in the mortgage field, self-employed borrowers always stand out as the more challenging opportunities. The self-employed borrower often finds themselves in a tug of war between their accountant’s guidance and the demands of the mort

Nov 09, 2018 | Mortgage Loan Process Specialized Forward Mortgages Non QM QM self-employed borrower bank statement loan mortgage

In the last six months, I have gone from adamantly avoiding the private label Reverse Mortgage program offerings for my clients to being an admirer and an outright endorser. The new Jumbo Reverse program looks nothing like the old one. The primary reason

Aug 22, 2018 | HECM Reverse Mortgage Eligibility for Reverse Mortgage Age in Place Jumbo Reverse Mortgage MIP HECM Changes 55+ High-Value Homes